In the evolving digital landscape, one of the most groundbreaking innovations reshaping the way agreements are made and enforced is the smart contract. Coined by cryptographer Nick Szabo in the 1990s, the term “smart contract” refers to self-executing agreements with the terms of the contract directly written into code. These contracts automatically execute and enforce themselves when predetermined conditions are met, eliminating the need for intermediaries and drastically improving efficiency and security.

With the rise of blockchain technology, smart contracts have transitioned from theoretical constructs to powerful tools with real-world applications across various industries. From decentralized finance (DeFi) and supply chain management to insurance and real estate, smart contracts are redefining trust, automation, and transparency.

This article explores smart contracts in detail, examining how they work, their components, advantages, challenges, and their potential to revolutionize industries across the globe.

What Are Smart Contracts?

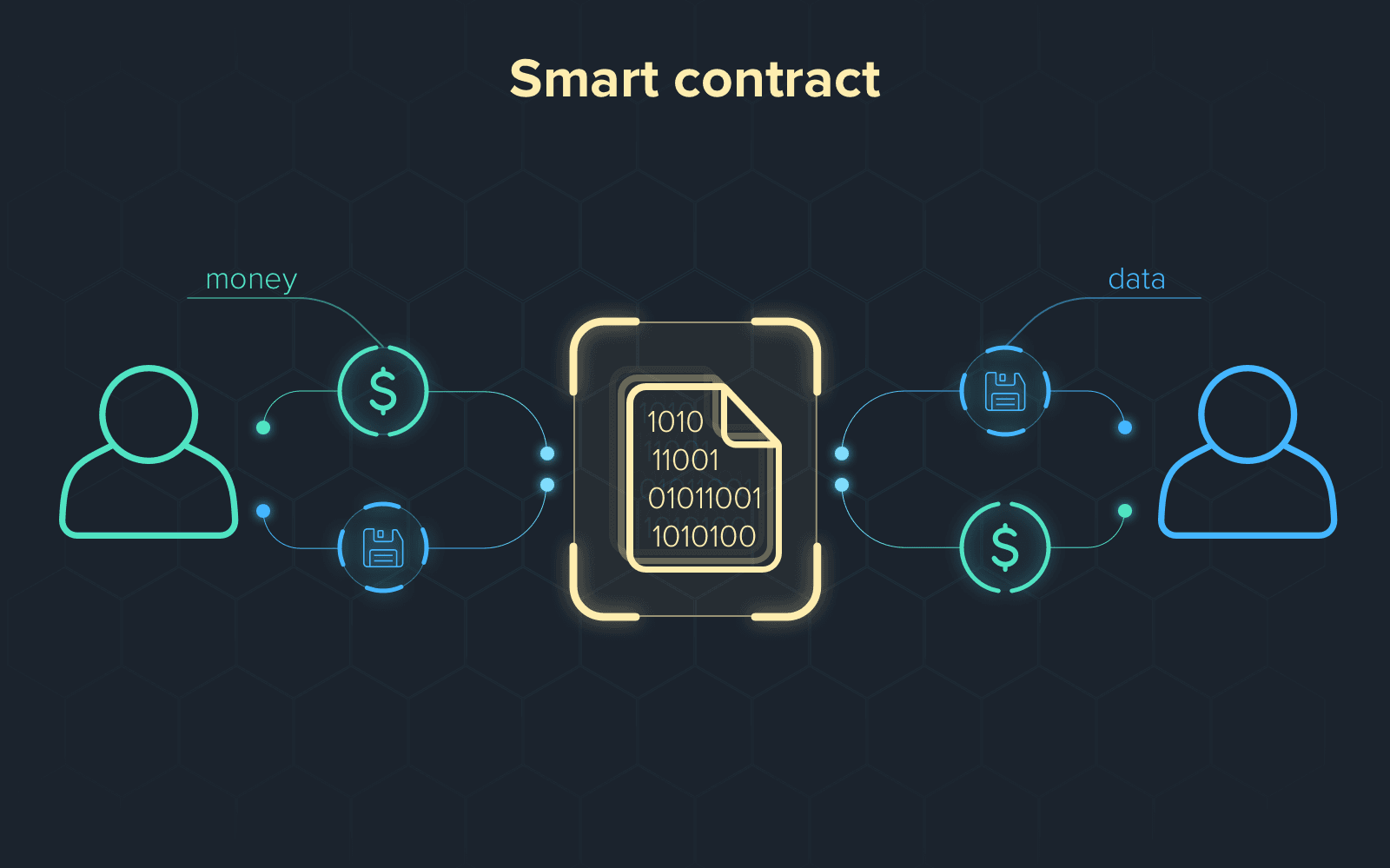

A smart contract is a digital protocol intended to facilitate, verify, or enforce the negotiation or performance of a contract. Unlike traditional contracts, which rely on legal systems and intermediaries for enforcement, smart contracts use code to manage the execution of contract terms automatically. These contracts live on a blockchain, a decentralized and immutable ledger that ensures transparency and security.

Smart contracts are composed of conditional statements—”if/when… then…”—written in programming languages such as Solidity (used on Ethereum). Once the specified conditions are fulfilled, the contract executes itself by triggering the agreed-upon actions, such as transferring tokens or verifying identities.

For example, in a rental agreement, a smart contract could be programmed so that once a tenant sends payment to the contract’s address, the access code to the rental property is automatically sent to the tenant.

Historical Background and Evolution

The concept of smart contracts predates blockchain technology. Nick Szabo introduced the idea in the 1990s to describe a set of promises, specified in digital form, including protocols within which the parties perform on these promises. Szabo used the example of a vending machine: inserting the right amount of money triggers the release of a product—no human intermediary required.

However, the implementation of smart contracts was limited until the development of blockchain. The launch of Bitcoin in 2009 offered a decentralized ledger, but it lacked the programmability required for complex contracts. This changed in 2015 with Ethereum, which introduced a platform capable of supporting programmable smart contracts through the Ethereum Virtual Machine (EVM).

Ethereum’s flexibility allowed developers to create decentralized applications (dApps) using smart contracts, opening the door to innovative use cases that continue to evolve today.

How Smart Contracts Work

1. Writing the Code

Smart contracts are written in specific programming languages, depending on the blockchain they are deployed on. The most common is Solidity, used primarily on Ethereum. Developers encode the logic of the contract using if-then conditions, outlining what happens when certain events occur.

2. Deployment on Blockchain

Once written and tested, the smart contract is deployed to the blockchain. Deployment involves publishing the contract’s bytecode (compiled code) to the network. Once deployed, the contract receives a unique address and becomes immutable—it cannot be changed or deleted.

3. Triggering Execution

The smart contract executes automatically when the predefined conditions are met. For example, if a condition states that a buyer must pay a specific amount of cryptocurrency to receive a product, once the payment is verified, the contract automatically triggers the transfer of ownership.

4. Consensus and Verification

The blockchain’s consensus mechanism (such as proof-of-work or proof-of-stake) ensures that the transaction is valid and records it on the blockchain. This creates an auditable and immutable record of the contract execution.

Key Components of Smart Contracts

- Digital Signature: Every party interacting with a smart contract must sign using their private keys. This ensures authenticity and agreement.

- Decentralized Ledger: Blockchain technology stores all transactions and contract executions in a transparent and immutable format.

- Oracles: These are third-party services that provide external data to the smart contract, such as price feeds or weather conditions.

- Contract Code: The actual instructions that define the terms and operations of the contract.

Benefits of Smart Contracts

1. Trust and Transparency

Smart contracts operate on decentralized ledgers visible to all participants. Once deployed, no single entity can alter them. This eliminates the need for trust between parties since the system ensures fairness and transparency.

2. Automation

By eliminating intermediaries, smart contracts reduce human intervention and errors. Once conditions are met, execution is immediate and automatic.

3. Cost Efficiency

Removing intermediaries like lawyers, brokers, or banks lowers the cost of transactions. Processes that usually take days and fees can now happen instantly at minimal cost.

4. Speed

Smart contracts operate 24/7 and execute within seconds once the criteria are met, significantly reducing transaction times.

5. Security

Because smart contracts are hosted on blockchains, they inherit the strong security protocols of the underlying blockchain, making them resistant to tampering and fraud.

Real-World Applications

1. Finance and Banking

Smart contracts are the backbone of DeFi (Decentralized Finance), enabling lending, borrowing, trading, and interest-earning without traditional banks. Platforms like Compound, Aave, and Uniswap rely heavily on smart contracts.

2. Supply Chain Management

Smart contracts provide end-to-end visibility and automation in supply chains. They can automatically release payments when goods reach certain checkpoints, reducing fraud and delays.

3. Insurance

In insurance, smart contracts automate claims processing. For example, flight delay insurance can use smart contracts connected to real-time flight data to automatically trigger compensation.

4. Real Estate

Buying or leasing property can be executed via smart contracts, which automate payment, ownership transfer, and document handling—speeding up the process and reducing bureaucracy.

5. Healthcare

Smart contracts can help manage patient records, consent forms, and insurance claims with secure data access and automation.

6. Gaming and NFTs

In blockchain-based games, smart contracts manage in-game assets and NFTs (non-fungible tokens), allowing transparent asset ownership and transfers.

Challenges and Limitations

Despite their potential, smart contracts face several challenges:

1. Code Vulnerabilities

Smart contracts are only as good as the code they’re written in. Bugs, logic errors, and security flaws can lead to catastrophic losses. The 2016 DAO hack on Ethereum resulted in a $60 million loss due to a vulnerability in a smart contract.

2. Immutability

Once deployed, smart contracts cannot be altered. While this ensures security, it also means bugs or errors cannot be corrected unless upgradeable contract frameworks are used.

3. Legal Recognition

Smart contracts exist in a legal gray area in many jurisdictions. There is still debate about their enforceability and how traditional legal systems should handle disputes involving smart contracts.

4. Scalability

Blockchain networks, especially Ethereum, have faced issues with scalability and high transaction fees, which can hinder widespread adoption.

5. Oracle Problem

Smart contracts cannot access real-world data on their own. They rely on oracles, which can be a point of centralization or manipulation if not properly designed.

6. User Interface and Complexity

Using smart contracts requires a level of technical expertise that the average user might not possess. Better user interfaces and abstraction layers are necessary for mainstream adoption.

The Future of Smart Contracts

The potential of smart contracts is immense and still largely untapped. As blockchain technology matures, we can expect smart contracts to become more secure, user-friendly, and legally integrated. Key trends shaping the future include:

1. Integration with AI and IoT

Smart contracts will increasingly integrate with artificial intelligence and the Internet of Things. For example, autonomous vehicles could use smart contracts to pay for tolls and charging stations.

2. Interoperability

Future smart contract platforms will support cross-chain interoperability, enabling contracts to interact across different blockchains seamlessly.

3. Legal and Regulatory Frameworks

Governments and regulatory bodies are gradually recognizing the importance of smart contracts. Clear legal frameworks will emerge to define their status, liability, and usage.

4. Upgradable Contracts

To overcome immutability issues, developers are creating patterns and tools that allow smart contracts to be upgraded without compromising security.

5. Layer 2 Solutions

Scalability solutions like rollups and sidechains are being developed to reduce transaction costs and increase the throughput of smart contract platforms.

6. Enterprise Adoption

Large corporations and institutions are exploring private and permissioned smart contracts to optimize their operations while maintaining confidentiality.

Ethical and Philosophical Considerations

Smart contracts, while technologically advanced, also raise important ethical questions. The automation of contracts removes the human element in decision-making. What happens in cases requiring empathy, discretion, or complex interpretation?

Moreover, who is responsible if a smart contract malfunctions or executes in unintended ways? As we hand over more responsibilities to code, questions about digital governance, accountability, and bias become increasingly critical.

The programmable nature of smart contracts also means that biases or malicious intent could be coded into the system. Therefore, transparency in development and inclusive design practices are essential to avoid reinforcing inequalities.